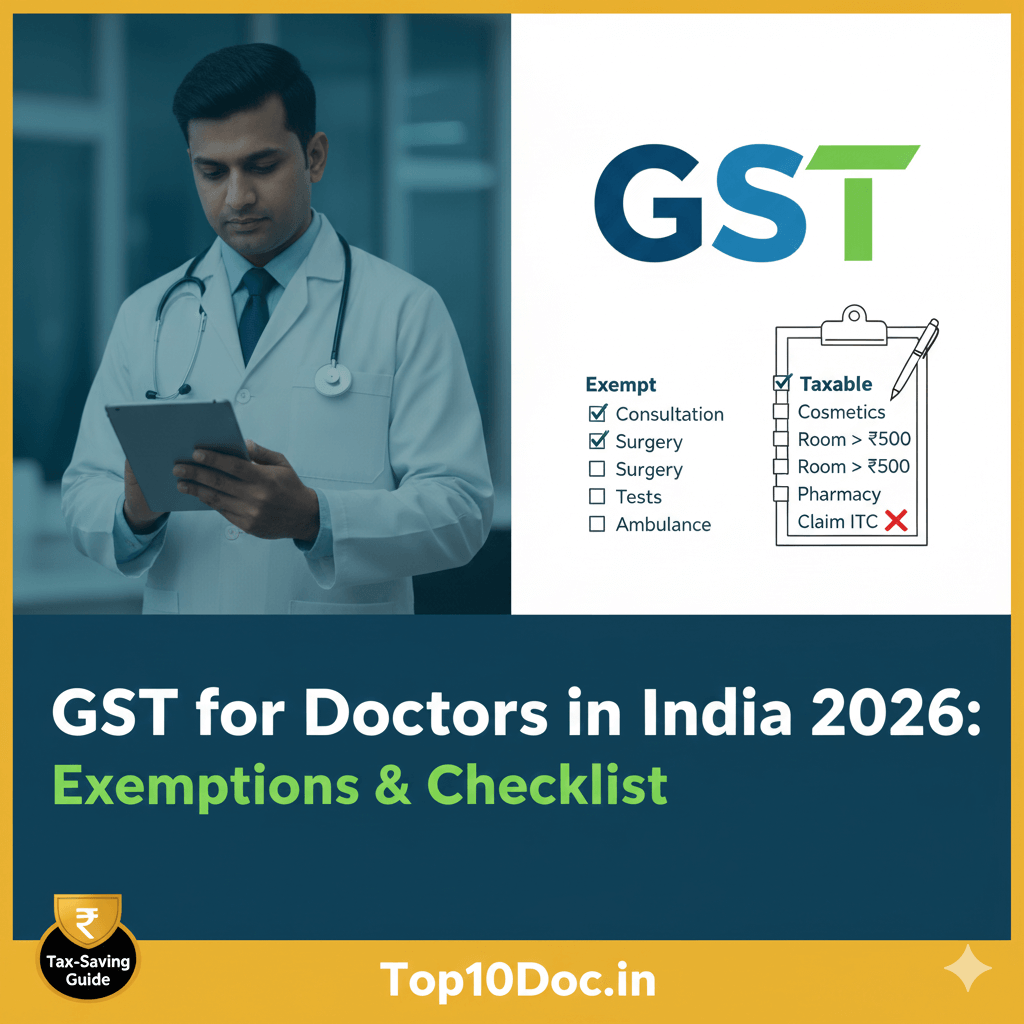

In 2026, the GST landscape for doctors in India has been fundamentally reshaped. With the full implementation of GST 2.0, the government has moved towards a “pro-patient, pro-practitioner” model by rationalizing tax slabs and removing burdens on essential care.

While your primary mission at top10doc.in is clinical excellence, understanding the nuances of the new two-slab structure (5% and 18%) is vital to avoid the “Audit Trap.” Here is an exhaustive deep dive into GST compliance for Indian doctors in 2026.

1. The Exemption Sanctuary: Core Healthcare Services

The foundational principle of GST in 2026 remains unchanged: Essential healthcare is a right, not a taxable luxury. Under Section 11 of the CGST Act, “Healthcare Services” provided by authorized medical practitioners are exempt from GST.

What falls under “Exempted Services”?

-

Consultation & Diagnosis: All fees charged for check-ups, follow-ups, and diagnostic opinions (both in-person and via telemedicine) are 0% GST.

-

Surgical Procedures: All life-saving or medically necessary surgeries.

-

Pathology & Radiology: Blood tests, MRIs, CT scans, and X-rays are exempt when provided as part of a patient’s treatment.

-

AYUSH Treatments: Recognized systems of medicine including Ayurveda, Yoga, Unani, Siddha, and Homeopathy enjoy full exemption.

-

Ambulance Services: Transportation for patients, whether provided by a private clinic or a government-affiliated service, is 100% exempt.

2. The Taxable Spectrum: Where GST Applies

The “Red Zones” are where doctors often face compliance issues. In 2026, the distinction between “Curing” and “Comfort” has become legally sharp.

A. Cosmetic & Aesthetic Procedures (18%)

The most significant area of taxation is cosmetic surgery. If a procedure is performed purely for beauty enhancement—such as elective Botox, dental veneers for a “Hollywood smile,” or elective hair transplants—it attracts 18% GST.

-

The Reconstructive Exception: If the same procedure is done to restore function or appearance after trauma, cancer, or a congenital defect (like a cleft lip), it is Exempt. Clear documentation of the “medical necessity” is mandatory to claim this exemption.

B. Hospital Room Rent (5% and 0%)

In 2026, the room rent rules are strictly tiered:

-

ICU/Critical Care: All beds in ICU, NICU, CCU, and ICCU are Exempt (0%), regardless of the price.

-

Non-ICU Rooms: If the daily rent exceeds ₹5,000, a 5% GST is levied on the total room charge. If the rent is ₹5,000 or less, it is exempt.

C. Pharmacy Sales: OPD vs. IPD

-

In-Patient (IPD): Medicines, implants (stents, joints), and consumables used for an admitted patient as part of a “bundled” treatment package are Exempt.

-

Out-Patient (OPD): If a patient buys medicine from your clinic’s retail pharmacy without being admitted, it is a taxable sale. Under GST 2.0, most medicines are taxed at 5%, while 36 specialized life-saving drugs (for Cancer and Rare Diseases) are now 0%.

3. The “Do’s” of GST for Doctors

To maintain a clean compliance record on top10doc.in, follow these active mandates:

-

Do Maintain Separate Records: Keep distinct books for “Exempt Healthcare” and “Taxable Supplies” (like pharmacy sales or rental income). This makes filing GSTR-1 and GSTR-3B significantly easier.

-

Do Monitor the Threshold: If your taxable turnover (not your total income) crosses ₹20 Lakh (or ₹10 Lakh in special category states like Mizoram), you must register for GST. Even if your clinical fees are ₹2 Crores, if your pharmacy sales are ₹21 Lakhs, you must register.

-

Do Issue a “Bill of Supply”: For all exempt services (consultations), you must issue a Bill of Supply instead of a Tax Invoice. This is a crucial distinction for your annual tax reconciliation.

-

Do Check the HSN/SAC Codes: Ensure your billing software is updated with the 2026 codes. For instance, SAC 9993 (Hospital Services) is exempt, while SAC 9996 (Wellness/Cosmetic) is taxable.

-

Do Disclose Exempt Turnover: Even if you pay zero tax, you are legally required to report your total exempt income in your GST returns if you are a registered entity.

4. The “Don’ts” of GST for Doctors

Avoid these common pitfalls that trigger notices from the GST Department:

-

Don’t Claim Input Tax Credit (ITC) on Exemptions: This is the most common mistake. You cannot claim credit for the GST you paid on hospital furniture, ACs, or surgical equipment if they are used to provide exempt clinical services.

-

Don’t Bundle Taxable Services into Packages to Avoid Tax: If you perform a cosmetic surgery and try to bundle it with an exempt consultation to hide the tax, the department may treat the entire package as taxable at the highest rate (18%) under the “Composite Supply” rule.

-

Don’t Charge GST on Ambulance Transfers: This is a zero-rated service. Charging tax here can lead to legal penalties and loss of your top10doc.in verification status for unethical billing.

-

Don’t Ignore “Reverse Charge Mechanism” (RCM): If you receive services from a lawyer or a foreign tech company for your clinic, you (the doctor) may be liable to pay GST directly to the government under RCM, even if you don’t charge GST to your patients.

-

Don’t Forget to Update Your Registration: If you move your clinic or open a branch in another state, you must update your GST profile or apply for a fresh registration in that state within 30 days.

5. Special Impact of GST 2.0 on Healthcare Infrastructure

One major benefit for doctors in 2026 is the reduction of tax on medical infrastructure.

-

Medical Equipment: The GST on most medical and surgical instruments has been slashed from 18% to 5%. This makes setting up a new OT or diagnostic center significantly cheaper.

-

Health Insurance: In a landmark move, individual health insurance premiums are now 0% GST. This has led to a massive surge in patients opting for private care, increasing the patient flow for verified doctors on platforms like top10doc.in.

Conclusion: Compliance as a Growth Strategy

In 2026, GST is no longer just about paying tax; it is about clinical transparency. For a doctor on top10doc.in, being “GST compliant” is a badge of honor. It shows that your practice is structured, your billing is transparent, and your credentials are legally sound.

By separating your “Cure” from your “Comfort” services and maintaining meticulous digital records, you ensure that your focus remains where it belongs: on the health and well-being of your patients.

GST & Registration FAQs

Are doctors exempted from GST? Yes, but only for “Healthcare Services.” This includes diagnosis, treatment, and care for an illness or injury. If you provide non-clinical services (like health coaching, gym consulting, or renting out your clinic space), those activities are taxable.

Is there any tax exemption for doctors? Under GST, your core clinical services are exempt (0%). Under Income Tax, you can use Section 44ADA (presumptive tax) or claim professional expenses (salaries, medical supplies, fuel, and depreciation on medical equipment) to lower your taxable income.

Who is exempted from GST registration in India? You are exempted from registration if your taxable turnover is below ₹20 Lakh (₹10 Lakh in special category states). Since most of your clinical income is exempt, you only count the income from taxable items like pharmacy sales or cosmetic procedures toward this limit.

Is GST registration mandatory for hospitals in India? Not if they only provide exempt healthcare. However, almost all hospitals must register because they have a Pharmacy (taxable at 5%) or Room Rents above ₹5,000 (taxable at 5%).

Is the GST registration limit 20 lakhs or 40 lakhs? For services (which includes doctors), the limit is ₹20 Lakh. The ₹40 Lakh limit only applies to businesses exclusively selling goods.

Income Tax & Earning FAQs

Are doctors eligible for 44ADA? Yes, and it’s a favorite for practitioners. In 2026, you can opt for this if your gross receipts are up to ₹75 Lakh (provided 95% of your income is digital). You simply declare 50% of your income as profit and pay tax on that—no need to maintain complex books of accounts.

Can a doctor earn 50 lakh per month? Absolutely. Top-tier surgeons (Neurosurgery, Cardiac, Robotic), senior consultants in corporate hospitals, and owners of specialized IVF or Diagnostic chains often earn or generate profits exceeding ₹50 Lakh per month.

How do doctors save taxes?

-

Presumptive Taxation: Using Section 44ADA to write off 50% of income as expenses.

-

Accelerated Depreciation: Claiming 40% (or current 2026 rates) depreciation on high-value medical machines like MRI/CT scans.

-

HUF (Hindu Undivided Family): Splitting income with a family entity to lower tax brackets.

-

Staff Salaries: Legally paying salaries to family members who assist in clinic management.

Which doctor’s salary is 1 crore? Senior Super-specialists (DM/MCh) in private practice or large corporate hospital groups. Common fields include Interventional Cardiology, Surgical Oncology, and Transplant Surgery.

Who is the richest doctor in India? As of 2026, Dr. Shamsheer Vayalil (founder of Burjeel Holdings) remains one of the wealthiest, with a net worth in the billions. Other medical billionaires include the families behind major pharmaceutical and hospital chains like Dr. Cyrus Poonawalla (Serum Institute) and the Reddy family (Apollo Hospitals).